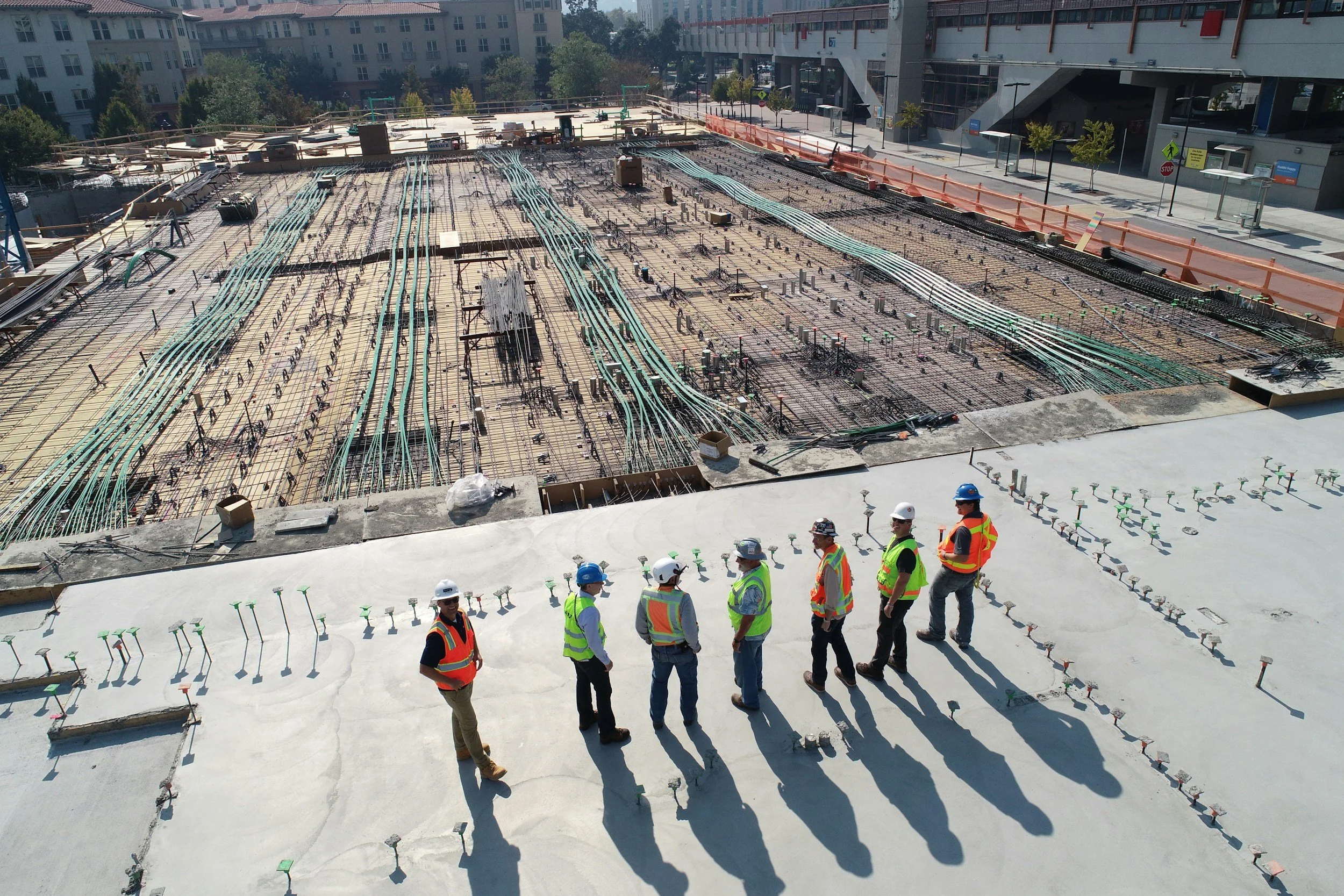

Building & Construction Tax

Australia's building and construction industry is a significant contributor to the country's economy, and as such, it is subject to a complex tax system. Understanding the various tax obligations and considerations is crucial for businesses and individuals operating within this sector.

Builders and trades professionals require accountants who comprehend the intricacies of the industry to navigate the unique financial challenges they face. Industry-specific accountants can provide tailored guidance on managing cash flow fluctuations, understanding complex tax regulations, maximizing deductions for equipment and materials, and optimising financial performance. With a deep understanding of construction processes, project costing, and industry-specific metrics, specialised accountants can offer invaluable insights to help builders and tradespeople make informed decisions, minimise tax liabilities, and enhance profitability. By partnering with accountants well-versed in the construction sector, builders and trades professionals can effectively streamline their financial operations and achieve long-term success in a competitive market.

We are experts in the building and construction accounting and tax space, delivering top-notch services to our clients. With our in-depth knowledge and experience, we are recognized as leaders in this field.

Who we work with:

Excavations

Architects

Surveyors

Engineers

Concreters

Bricklayers

Electricians

Structural Steel Fabricators

Carpenters

Roofers

Plumbers

Renderers

Landscapers

Heating & Cooling Specalists

Painters

Cabinet Makers/Joinery

What we can help you with:

Accounting

Business Advisory

Bookkeeping

Accounting Software

Payroll, Superannuation

GST, Fuel Tax Credits

Tax Advice & Planning

BAS Lodgement

Areas we serve:

Melbourne based but will serve all across Australia